One of the very first things that I was taught when I joined the National Bus Company, was a very simple mantra that I have never forgotten from that day to this, some 42 years ago: “All you have to do is make sure that the bus goes out so the money comes in.” Obvious, you may think, but in truth a very true fact. Avoiding lost mileage is the battle that is endured day in, day out across depots up and down this green and pleasant land.

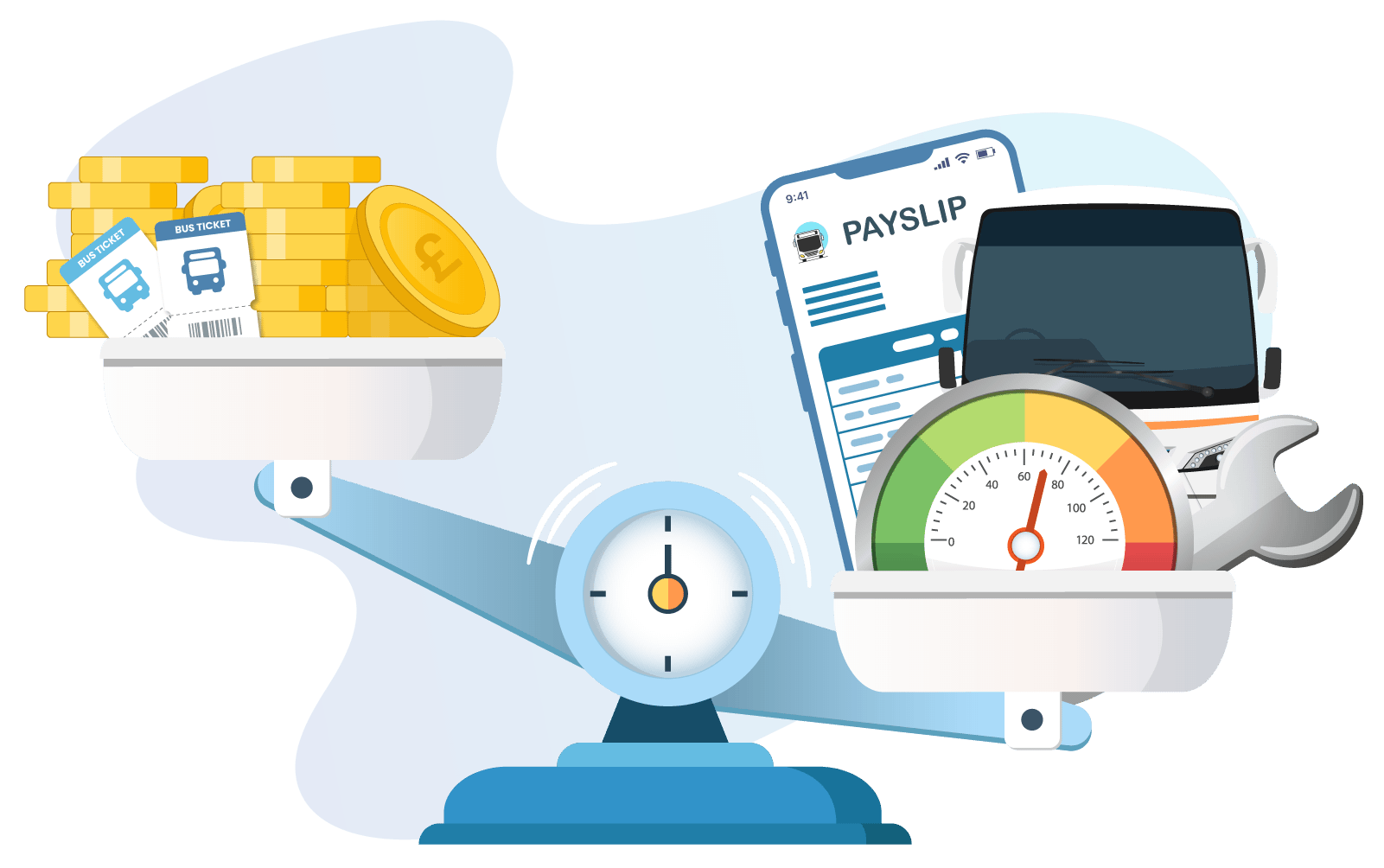

However, while it is great to ensure that full mileage is operated, with the best will in the world, if the costs of operating full services are greater than the money you are getting from the farebox (or today’s cash-free equivalent), then the reality is that you stand a real chance of going out of business. Basic economic principles apply to both regulated and deregulated operating environments. Efficient housekeeping and cost control are essential to running a profitable business, be that buses or baking. Without doubt, the greatest costs are staff wages, and it has been interesting to observe, especially since COVID, a significant increase in industrial action across the UK as trade unions ballot for action to try to secure, in some cases, very considerable pay increases.

So, what are the very latest trends that have recently been published by CPT in their very useful Transport Cost Monitor? The truth is, that inflation in both staff costs and maintenance-related costs has resulted in a 4% increase. Some might say that does not sound like a lot; however, the reality is that bus companies run on very tight margins at the best of times, so, if truth be told, that is going to have an impact. This report is the sixth of the Cost Monitor reports, which are delivered twice a year. The data is collated by 52 operators and represents over 17,000 peak vehicles and an impressive 67% of total bus mileage operated in Great Britain.

As ever, the challenge of recruiting and retaining enough drivers, against a long trend of driver shortages (as evidenced in the CILT‘s Driver Shortage Crisis 2022 report, and CILT/BusMark’s 2023 snapshot work on recruitment and development), has resulted in a 6.6% increase in labour costs against the August inflation rate of 2.2%, as calculated on the Consumer Prices Index. The 12-month rate is forecast to remain over 2% for the rest of 2025, with some predictions suggesting a potential rise to 3.7% in September before easing later in the year. Either way you look at it, labour costs far exceed the current level of inflation. The report also shows considerable variation, with operators in Wales experiencing a rather painful 5.8% increase in costs and a 30.2% increase in overheads, compared to 7.1% across the country. In contrast, English metropolitan areas were hit by a rise of only 2.1%.

It is quite apparent that operating buses in Wales is a great deal harder than it is in other parts of the UK, and with further industrial action predicted across the rest of Great Britain it will be difficult not to increase costs for passengers, which is always unfortunate. But survival and, indeed, investment are vital if the industry is to deliver safe and reliable bus services that can realise the green transport plans that we all aspire to achieve, so that we can keep the nation moving.

Origin

Making operational excellence the standard across the transport industry.

Written by Austin Birks